Flyfish Review – Optimize Business Expenses With a Financial Management System

Any business, no matter how big or small, needs to manage payroll in order to keep operations running smoothly. Similarly, you need to pay suppliers on time to avoid any disruptions to operations. But when you’re managing the payroll manually, it can be difficult to keep track of things, let alone ensure accurate recordkeeping. And what’s the point if you’re spending so much time on payroll management and still end up with errors? The best way to keep this from happening is to adopt a technology-based system. In this Flyfish review, I’ll talk about one such option and how it can benefit companies.

When it comes to financial management solutions, you can either opt for software or a comprehensive service. Flyfish is the latter, and unlike software that’s already available on the market, it can personalize your solutions.

Contents

Cut Back On Hefty Business Costs

An important aspect of Flyfish is that it provides business debit cards for better cost control and expense management. By providing employees with a separate debit card for day-to-day business expenses, you’re able to stay on top of these purchases. More importantly, you can avoid the hassle of securing approvals for expenses before making a payment for a specific purchase. Having a business debit card also gives you the ability to manage employee expenses without the stress of using a different platform.

Now, you can set rules and limits for these cards. Since the system is cloud-based, you can adjust spending limits and rules by reviewing transactions at any time of the day. And if team members end up needing to pay for additional travel expenses, you can reimburse them with a few simple clicks. Flyfish also makes it easier to cut back on unnecessary costs by setting spending rules and limits. This way, you avoid any out-of-policy expenses.

Make Secure Transactions

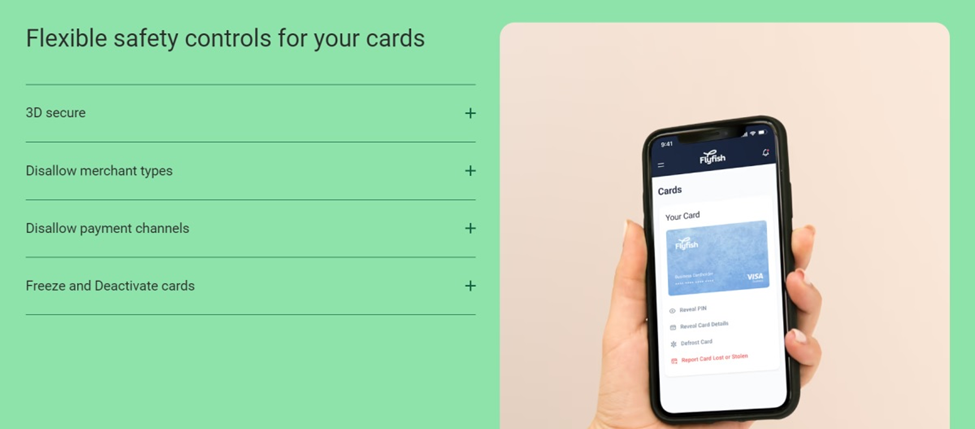

If you’re partnering with international vendors and suppliers, you can get a great deal on affordable materials. However, there’s always a concern about having to make international transactions. By signing up for a unique dedicated business IBAN with Flyfish, your company can make secure payments to merchants and vendors. Moreover, you get the added flexibility of setting safety controls for your cards.

The system makes sure that only authorized cardholders are using the business debit card to make purchases. To avoid expenses in specific domains, you can also block certain merchants or merchant types. This is easy to do on a card or company level – you can customize the rules on everything! Similarly, if you’re worried about employees using debit cards for personal expenses, you can block card usage for online purchases or ATM cash withdrawals.

Spend More Time on Business Growth

When you have experts to manage your finances, you can spend more time growing the business and less time on organizing the payroll. This is thanks to the modern and agile platform, which lets you fund the dedicated business IBAN instantly. You can quickly manage access to your business funds from the account as well. And when you have a secure business debit card, you can reimburse partners and suppliers easily. That’s because transferring funds to the card is a piece of cake, and they can access the funds immediately, too. Similarly, you can issue unlimited corporate cards to meet your business needs, whether it’s to pay employees, vendors, or partners. What’s more, is that you get centralized control of all accounts from a single place.

Monitor Expenses 24/7

If you’ve been using a manual system to keep a record of expenses up until now, one of the greatest downsides is that you can’t access it all the time. Rather, you need to pay hefty amounts to keep the infrastructure in place. In contrast, a solution like Flyfish is cloud-based, so you can monitor expenses and transactions from anywhere as long as you’re registered.

For instance, you have 24/7 access to the platform, which allows you to monitor each transaction and business expense as it happens. Similarly, you can set specific criteria for transactions that can be approved, declined, or flagged as suspicious. And if a card is used to make an unauthorized purchase, you have the option to freeze cards automatically.

Bottom Line

To summarize the things I’ve discussed in my review up until now, Flyfish is a useful solution for companies that want to spend less time worrying about transactions and payroll. After your business registers for a dedicated business IBAN, you can avoid hefty transaction fees and easily send and receive money internationally. Plus, handing over payroll management to Flyfish means that you no longer need to handle labor-intensive tasks like calculating tax withholdings. Now, you’ll have more time to focus on aspects that allow business growth, like marketing and development. At the same time, you can monitor and track expenses around the clock without any worries.

Also Read: Top 10 Self-Custody Wallets for Cryptocurrency: User Reviews & Comparisons