SBBJ IFSC Code: State Bank of Bikaner and Jaipur IFSC Codes

The SBBJ IFSC code is an important identifier for the State Bank of Bikaner and Jaipur (SBBJ), a former associate bank of the State Bank of India (SBI). This unique code plays a crucial role in electronic transactions such as NEFT, RTGS, and IMPS, ensuring secure and efficient fund transfers. If you need to transfer money online to an SBBJ bank account, knowing the correct SBBJ IFSC code is essential.

Read Also: Maharashtra Gramin Bank Balance Check Number Simplified

Contents [show]

What is an SBBJ IFSC Code?

An SBBJ IFSC code is an 11-character alphanumeric code assigned by the Reserve Bank of India (RBI) to each branch. The code helps identify specific branches, making electronic transactions smooth and error-free. Every bank branch in India that supports online banking has an IFSC code.

For example, the IFSC code for the SBBJ Masuda branch in Ajmer, Rajasthan is SBBJ0011175. This means:

The first four letters (SBBJ) represent the bank name.

The fifth character is always zero (0), which is reserved for future use.

The last six digits (011175) identify the specific branch.

This structure ensures that the IFSC code is unique for every branch, allowing safe and accurate transactions.

Why is an SBBJ IFSC Code Important?

The SBBJ IFSC code is used for multiple banking transactions. Without it, electronic transfers are not possible. Here are some key uses:

Online Banking Transactions – The IFSC code is required for NEFT, RTGS, and IMPS transactions.

Fund Transfers Between Banks – It helps in sending money from one bank to another.

UPI Transactions – It is used for identifying the sender and receiver’s bank details.

Loan Applications – The code is required when applying for a home loan, personal loan, or any financial service.

Business Payments – Businesses use it for vendor payments and payroll transfers.

How to Find an SBBJ IFSC Code?

If you need to find a IFSC code, there are multiple ways to get the correct details:

Bank Passbook or Cheque Book – The IFSC code is printed on the first page of the passbook and on cheque leaves.

Bank’s Official Website – Visit the official SBI website (since SBBJ merged with SBI in 2017) to search for the branch IFSC code.

Reserve Bank of India (RBI) Website – The RBI updates IFSC codes regularly, making it a reliable source.

Branch Visit – You can visit the nearest SBBJ/SBI branch and ask for the IFSC code.

Internet Search – Simply search “SBBJ IFSC Code [branch name]” on Google to get the required details.

List of SBBJ IFSC Codes for Major Branches

Here is a table with some important IFSC codes for key branches across Rajasthan:

| Branch Name | IFSC Code | Location | District |

|---|---|---|---|

| SBBJ Masuda | SBBJ0011175 | Ajmer, Rajasthan | Ajmer |

| SBBJ Station Road Ajmer | SBBJ0010104 | Ajmer, Rajasthan | Ajmer |

| SBBJ Makhupura Ind. Estate | SBBJ0010105 | Ajmer, Rajasthan | Ajmer |

| SBBJ Roopangarh | SBBJ0011008 | Ajmer, Rajasthan | Ajmer |

| SBBJ Pushkar | SBBJ0010602 | Pushkar, Rajasthan | Ajmer |

These IFSC codes ensure that transactions are completed without errors. If you are sending money to any of these branches, always double-check the IFSC code.

Read Also: Aadhar Card Se Bank Balance Check: Complete Information

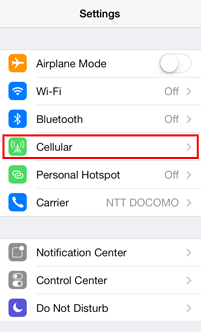

How to Use an IFSC Code for Online Transactions?

If you are transferring money to an SBBJ bank account, follow these simple steps:

Login to Your Internet Banking or Mobile Banking App.

Select the “Funds Transfer” Option.

Choose the Payment Method – NEFT, RTGS, or IMPS.

Enter the Recipient’s Details:

Name

Bank Account Number

SBBJ IFSC Code

Confirm and Authenticate the Transaction.

Receive Confirmation of the Successful Transfer.

This process ensures that your funds are securely transferred to the correct SBBJ branch without any delays.

How Does the SBBJ IFSC Code Work?

The SBBJ IFSC code allows banks to identify the sender and receiver instantly. For example:

If Person A in Delhi transfers money to Person B’s SBBJ account in Ajmer, the system checks the SBBJ IFSC code to verify the branch.

The money is then electronically routed to the correct account within minutes.

Without the correct IFSC code, transactions can fail or get delayed.

What Happened to SBBJ After Merging with SBI?

In 2017, the State Bank of Bikaner and Jaipur (SBBJ) merged with the State Bank of India (SBI). After this, many IFSC codes changed to reflect the SBI IFSC code format. However, some older SBBJ IFSC codes are still valid for transactions.

If you had an account with SBBJ before the merger, it’s important to check whether your IFSC code has changed. You can do this by:

Logging into SBI Net Banking and verifying the branch code.

Checking the latest bank statement or passbook.

Calling the SBI customer care for updated IFSC details.

How to download mini statement?

Downloading a mini statement helps you check your recent bank transactions. You can do this using various methods:

Mobile Banking App – Login to your bank’s app, go to “Mini Statement,” and view or download it.

SMS Banking – Send a specific SMS format (e.g., SBI: “MSTMT” to 09223866666) from your registered mobile number to receive your last transactions.

Net Banking – Log in to your bank’s website, go to “Account Statement,” and check or download your mini statement.

ATM Machine – Insert your ATM card, enter your PIN, and select “Mini Statement” to get a printout.

Missed Call Banking – Give a missed call to your bank’s mini statement number (e.g., SBI: 09223866666), and receive an SMS with your last transactions.

These methods are quick, secure, and free (within limits). Ensure your mobile number is. Linked to your bank account for SMS and missed call services.

Conclusion

The SBBJ IFSC code is essential for online banking, fund transfers, and digital transactions. Whether you’re sending money via NEFT, RTGS, or IMPS, using the correct IFSC code ensures that your funds reach the right bank account safely. If you’re unsure about your IFSC code, use the bank passbook, cheque leaf, or RBI website to verify it.

Even though SBBJ merged with SBI, many older IFSC codes are still in use. If you frequently transfer money to a bank account, always check the latest IFSC code updates from SBI. Ensuring that you have the right IFSC code will make your banking transactions seamless and error-free.