Understanding Investor Risk Assessment: A Simple Guide for First-Time Investors

Investing your hard-earned money can be daunting, especially for first-time investors. There are countless opportunities and avenues to explore, but with them come varying levels of risk. To make informed investment decisions, it’s essential to understand the concept of risk and how it applies to your investments. In this guide, we’ll introduce you to investor risk assessment and explore the significance of startup due diligence in your investment journey.

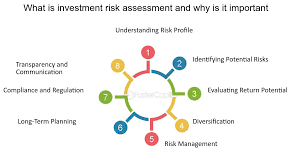

What is Investor Risk Assessment?

Before delving into startup due diligence, let’s clarify investor risk assessment. Simply put, it’s evaluating the potential risks associated with an investment opportunity. It helps investors make informed choices by considering factors that could impact their investment’s returns.

Understanding Risk Tolerance

Determining your risk tolerance is one of the first steps in investor risk assessment. Your risk tolerance is your ability and willingness to withstand fluctuations in the value of your investments—financial goals, investment horizon, and personal comfort level with risk influence it.

If you’re starting your investment journey, you might have a lower risk tolerance, preferring more conservative investments like bonds or index funds. On the other hand, seasoned investors may have a higher tolerance and be open to riskier opportunities such as startups.

The Role of Startup Due Diligence

Let’s focus on the keyword we introduced earlier: “Startup Due Diligence.” This term is crucial for those interested in venture capital or startup investments. Startup due diligence involves thoroughly investigating a startup company before investing.

Why is Startup Due Diligence Important?

1. Risk Mitigation: Startups carry higher risks due to unproven track records. Through due diligence, you can identify potential red flags and mitigate risks associated with the startup’s business model, financial health, and market conditions.

2. Understanding the Business: It’s essential to grasp the startup’s core business, market niche, and competitive landscape. This knowledge helps you assess the startup’s growth potential and sustainability.

3. Financial Analysis: Analyzing the startup’s financial statements and projections helps gauge its economic health. It allows you to make informed decisions about the potential returns on your investment.

4. Legal and Regulatory Compliance: It is vital that the startup comply with all legal and regulatory requirements. Please do so to avoid legal issues that may affect your investment.

Steps in Startup Due Diligence

Here are some essential steps to perform startup due diligence effectively:

1. Business Plan Analysis: Review the startup’s business plan, market strategy, and growth projections.

2. Financial Statements: Examine the company’s financial statements, including income statements, balance sheets, and cash flow statements.

3. Management Team: Evaluate the qualifications and experience of the startup’s management team.

4. Market Research: Conduct thorough market research to understand the industry and competition.

5. Legal and Compliance Checks: Verify that the startup complies with all legal and regulatory requirements.

6. Customer and Supplier Relationships: Assess the strength of the startup’s relationships with customers and suppliers.

7. Evaluating Competitive Advantage: During your startup due diligence, assessing the startup’s competitive advantage is essential. What sets it apart from others in the industry? Does it have a unique product, technology, or market positioning that can drive growth and profitability?

8. Scalability and Growth Potential: Consider the startup’s scalability and growth potential. Does its business model allow for expansion, and is there a clear path to increased market share? Understanding these factors can help you gauge the long-term viability of your investment.

9. Exit Strategy: Explore the startup’s exit strategy. How does the company plan to provide returns to investors? Knowing the potential exit options, such as acquisition or initial public offering (IPO), can influence your investment decision.

10. Diversification: Diversifying your investment portfolio is a common strategy to manage risk. While startup investments can be appealing, consider how they fit into your overall investment strategy and ensure you maintain a diversified portfolio.

11. Seek Expert Advice: If you’re new to startup investing, don’t hesitate to seek advice from experienced investors, financial advisors, or venture capitalists. Their insights and guidance can be invaluable in navigating the startup landscape.

12. Risk-Return Trade-off: Risk and return are closely linked in investing. While startups offer the potential for high returns, they also come with higher risks. It’s essential to strike a balance that aligns with your financial goals and risk tolerance.

Conclusion

Investor risk assessment is crucial to making sound investment decisions. Understanding your risk tolerance and performing due diligence, especially in the context of startup investments, can help you navigate the complexities of the investment landscape.