Exploring the Wealth of Insights: Unveiling Taiwan’s ESG Dataset

Welcome to the world of ESG, where sustainability meets data-driven insights! In today’s blog post, we will be delving into taiwan ESG dataset, a fascinating realm filled with eye-opening discoveries and actionable information. Discover how ESG criteria have become essential in evaluating a company’s performance beyond financial metrics. Taiwan stands out as a pioneering leader in unlocking the power of ESG data with its comprehensive and precisely curated dataset.

Let’s explore how businesses can utilize this treasure trove to drive positive change and reap long-term benefits. Get ready as we embark on this adventure together!

Contents [show]

What is the Taiwan ESG Dataset?

The Taiwan ESG Dataset is a comprehensive resource focusing on the environmental, social, and governance aspects of Taiwanese businesses. It offers insights into sustainability efforts, covering metrics like carbon emissions and diversity in leadership. Notable for its meticulous approach, the dataset ensures accuracy through careful source selection and rigorous analysis.

It allows businesses to benchmark, providing actionable insights. Beneficial for both companies and investors, it enables informed decision-making aligned with sustainable principles. The dataset fosters corporate accountability by promoting transparency in ESG practices, encouraging companies to improve sustainability indicators proactively.

Key Findings and Insights from the ESG Dataset

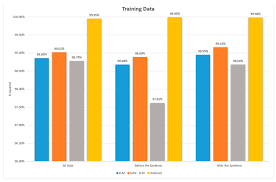

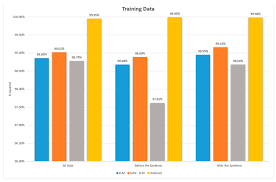

An in-depth analysis of the Taiwan ESG Dataset has revealed several key findings that shed light on the environmental, social, and governance practices of companies in Taiwan:

- Advancements in Sustainability: Taiwanese companies are actively implementing measures to reduce their carbon footprint and promote renewable energy sources. This commitment reflects a commendable dedication to environmental responsibility, aligning with global initiatives to combat climate change.

- Social Responsibility Impact: The dataset underscores the significance of social factors in assessing company performance. Businesses prioritizing diversity and inclusion tend to outperform peers financially. This correlation emphasizes that fostering an inclusive work environment not only benefits societal well-being but also contributes to enhanced business success.

- Governance for Long-Term Viability: Governance practices play an important role in determining a company’s long-term viability. Instances within the dataset highlight that strong corporate governance leads to better risk management and increased shareholder value.

- Growing Investor Focus on ESG: The dataset reflects a notable shift in investor behavior, with increasing consideration of ESG factors in investment decisions. Companies with robust ESG practices are more attractive to investors who recognize the potential for sustainable growth.

- Sector-Specific Insights: Analysis of sector-specific trends within the dataset provides insights into industries excelling or facing challenges in adopting sustainable practices. Policymakers can leverage these insights to implement targeted regulations or incentives, fostering sustainability across diverse sectors.

In conclusion, exploring the Taiwan ESG Dataset unveils how companies are navigating sustainability challenges while capitalizing on growth opportunities. These findings, when incorporated into decision-making processes, hold the potential to propel both businesses and society toward a more sustainable future.

How Companies Can Benefit from Utilizing this Data?

Companies across industries can reap significant benefits by leveraging the wealth of insights provided by the Taiwan ESG Dataset.

- Internal Performance Enhancement: Companies can gain a thorough understanding of their own ESG performance by assessing key metrics. This self-evaluation helps identify areas for improvement and allows the implementation of targeted strategies to enhance sustainability practices.

- Benchmarking Against Peers: The ESG Dataset enables businesses to benchmark themselves against industry peers and competitors. The comparative analysis identifies best practices and sets realistic improvement goals. Excelling in ESG areas enhances reputation among stakeholders, including investors, customers, employees, and regulators.

- Driving Innovation: Companies can use data-driven insights to drive innovation, uncovering new growth opportunities. Understanding emerging trends in sustainable business practices and market demands for responsible products or services positions organizations to mitigate risks and stay ahead of the curve.

- Attracting Socially Conscious Investment: Aligning operations with ESG principles based on dataset analytics attracts investment from socially conscious investors. As these investors prioritize sustainability, access to this capital becomes important for long-term financial success.

- Promoting Long-Term Value Creation: Integrating ESG considerations into corporate decision-making promotes long-term value creation over short-term profits. Responsible business practices, guided by reliable information from the ESG Dataset, contribute positively to global sustainability targets and enhance a company’s resilience amid evolving stakeholder expectations.

In conclusion, the use of the Taiwan ESG Dataset offers a range of benefits, including improved transparency, enhanced risk management, and increased competitiveness within a market landscape increasingly shaped by sustainability imperatives.

The Impact of ESG on Sustainable Development

ESG, encompassing Environmental, Social, and Governance criteria, is a powerful driver of sustainable development. Its incorporation into business decision-making processes enables companies to contribute positively to both environmental and social aspects.

- Environmental Stewardship: ESG encourages practices that minimize the ecological footprint, such as reducing emissions, conserving resources, and implementing effective waste management. Prioritizing sustainability in operations helps businesses mitigate climate change and preserve natural resources.

- Social Responsibility: In the social realm, ESG emphasizes fair labor practices, diversity, and inclusive workplace cultures. This includes fair pay, safe working conditions, equal opportunities regardless of gender or ethnicity, enhancing employee satisfaction, and contributing to building more equitable societies.

- Governance Excellence: The governance aspect of ESG centers on transparency and accountability in corporate decision-making. It involves establishing robust systems for ethical conduct at all organizational levels. Strong governance frameworks lead to responsible decisions with a focus on long-term impacts over short-term gains.

By integrating ESG principles into their strategies and operations, companies become agents of positive change. This goes beyond regulatory compliance, reflecting a genuine commitment to creating a better world for stakeholders—shareholders, employees, customers, communities, and the planet itself.

Challenges and Limitations of the ESG Dataset

The Taiwan ESG Dataset, while rich in insights, faces challenges and limitations that merit consideration:

- Data Availability and Reliability: Voluntary disclosure of ESG information by companies may lead to discrepancies in reporting standards and incomplete data. Ensuring reliability and consistency across datasets remains a challenge.

- Lack of Standardized Metrics: The absence of standardized metrics for measuring ESG performance poses a challenge. Differing stakeholder expectations make it difficult to compare companies across industries or regions, hindering a universal assessment framework.

- Interpretation Complexity: Interpreting the data necessitates expertise in both finance and sustainability. Extracting meaningful insights from complex datasets can be resource-intensive and time-consuming.

- Quantitative vs. Qualitative Aspects: While quantitative data provides valuable information, it may overlook qualitative aspects such as corporate culture or stakeholder engagement. A holistic understanding of a company’s sustainability practices may require additional qualitative insights.

- Risk of Greenwashing: There is a risk of greenwashing, where companies may present an exaggerated or misleading picture of their environmental efforts. This poses a challenge to the credibility of ESG reporting and necessitates vigilant scrutiny.

Conclusion: Harnessing the Power of ESG for a Better Future

The Taiwan ESG Dataset is a powerful guide for businesses, offering more than a snapshot of environmental, social, and governance practices. Its correlation with financial outperformance highlights the dual benefits of sustainability for business success and societal well-being. Leveraging this dataset provides a competitive edge, aiding in improvement strategies, reputation reinforcement, and attracting investors aligned with sustainable values.

Its impact transcends individual companies, contributing to global sustainability goals. Despite challenges, including reliance on self-disclosure, the dataset remains a catalyst for progress, fostering accountability and collaborative efforts. It represents a collective stride towards a more sustainable, equitable, and resilient future.

Also Read: Navigating the Commercial Real Estate Landscape: 10 Essential Tips for Success