What Exactly is Recoverable Draw, and How Does it Affect Your Compensation Package?

Contents [show]

Introduction:

Navigating the intricacies of compensation packages often leads to questions about various components, and one common query is, “What Exactly is Recoverable Draw?” This comprehensive guide aims to demystify recoverable draw, shedding light on its definition, implications for compensation, and the distinction between recoverable and non-recoverable draw.

Understanding Recoverable Draw

Definition:

Recoverable draw refers to a form of advance payment provided to employees, typically in sales or commission-based roles, to ensure a steady income stream during periods of lower earnings. This component allows employees to meet their financial needs without solely relying on commissions or bonuses.

Mechanics of Recovery:

The recovery aspect involves deducting the previously provided draw amount from future earnings, creating a system where employees repay the advanced sum through subsequent commissions or bonuses.

Common Usage:

Recoverable draw is commonly employed in industries where income fluctuations are prevalent, offering stability to employees while maintaining a connection between compensation and performance.

Non-Recoverable Draw: A Distinctive Approach

Definition:

Non recoverable draw, in contrast, represents an advance payment that does not require repayment from future earnings. This model allows employees to enjoy a consistent income without the obligation of repayment.

Earning Stability:

Non-recoverable draw provides a stable income source, allowing employees to focus on their roles without the pressure of repaying advanced amounts during lean periods.

Industry Variances:

The choice between recoverable and non-recoverable draw often depends on industry norms, company policies, and the nature of the roles within the organization.

The Impact of Recoverable Draw on Compensation Packages

Predictable Income:

Recoverable draw contributes to a more predictable income for employees, offering financial stability even during months with lower commissions or bonuses.

Performance Alignment:

The recovery mechanism ensures that employees remain aligned with performance expectations, as the advanced draw is tied to future earnings.

Balancing Risk and Reward:

Employers use recoverable draw to balance the inherent risks in commission-based roles, providing a safety net for employees while maintaining a connection between compensation and results.

Non-Recoverable Draw: Embracing a Different Compensation Paradigm

Immediate Financial Support:

Non-recoverable draw offers immediate financial support without the burden of repayment, giving employees the freedom to allocate their earnings as needed.

Reduced Performance Pressure:

The absence of repayment requirements alleviates performance pressure on employees, allowing them to focus on their roles without the added stress of recovering advanced amounts.

Attracting Talent:

Companies utilizing non-recoverable draw may attract talent seeking stability and financial predictability in their compensation packages.

Distinguishing Factors: Recoverable vs. Non-Recoverable Draw

Repayment Obligation:

The primary distinction lies in the repayment obligation associated with recoverable draw, where employees are required to reimburse the advanced amount from future earnings.

Risk Mitigation:

Recoverable draw serves as a risk mitigation strategy for employers, ensuring a balance between providing financial support and aligning compensation with performance.

Employee Preferences:

Understanding employee preferences is crucial in determining whether recoverable or non-recoverable draw aligns better with the workforce’s needs and expectations.

Recoverable Draw: Pros and Cons

Pros:

1. Financial Stability: Provides a stable income during low-earning periods.

2. Performance Alignment: Aligns employee performance with compensation.

Cons:

1. Repayment Pressure: Employees face the pressure of repaying advanced amounts.

2. Variable Earnings: The recovery mechanism ties compensation to variable earnings.

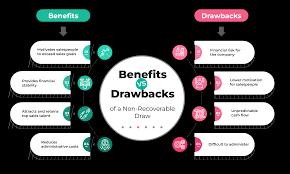

Non-Recoverable Draw: Advantages and Disadvantages

Pros:

1. Immediate Support: Offers immediate financial support without repayment obligations.

2. Reduced Stress: Relieves employees from the stress of recovering advanced amounts.

Cons:

1. Fixed Income: Provides a fixed income without the potential for recovery from future earnings.

2. Attracting Talent: May attract employees seeking stability, potentially limiting the talent pool.

The Role of Recoverable Draw in Sales and Commission-Based Roles

Common Industries:

Recoverable draw is frequently employed in industries such as real estate, sales, and other commission-centric roles.

Stability in Variable Markets:

In markets with inherent variability, recoverable draw serves as a stabilizing factor, allowing employees to navigate fluctuations.

Making Informed Choices: Employer Considerations

Industry Norms:

Employers must consider industry norms and practices when deciding between recoverable and non-recoverable draw.

Employee Feedback:

Seeking feedback from employees helps tailor compensation packages to their preferences, contributing to overall satisfaction and retention.

The Future Landscape: Adapting Compensation Strategies

Flexibility:

The future may see a greater emphasis on flexible compensation strategies, allowing organizations to adapt to evolving industry dynamics.

Employee-Centric Approaches:

Adapting compensation strategies to be more employee-centric ensures that organizations remain competitive in attracting and retaining top talent.

In summary, comprehending the intricacies of recoverable draw stands as a fundamental necessity for both employers and employees. This particular element assumes a pivotal role in sculpting compensation packages, exerting a significant influence on financial stability, and delicately managing the inherent risks and rewards within commission-based professions.

In the relentless evolution of the workforce landscape, employers must maintain a keen awareness of shifting employee preferences, emerging industry trends, and the dynamic contours of compensation structures. Making judicious decisions concerning recoverable draw, informed by thoughtful consideration of employee feedback, empowers organizations to craft compensation packages that transcend the conventional. These packages are not merely remuneration structures but become instrumental in fostering a dynamic, motivated, and deeply committed workforce.

By adapting to the ever-changing expectations and needs of their employees, organizations can navigate the challenges of a modern and competitive job market. In this pursuit, the strategic deployment of recoverable draw serves as a tool for attracting and retaining top talent, aligning individual goals with organizational objectives, and cultivating a workplace culture that thrives on mutual respect, collaboration, and shared success. Thus, the quest for a well-balanced, responsive compensation strategy becomes the cornerstone of building a workplace that not only endures change but propels forward with resilience and vitality.

.