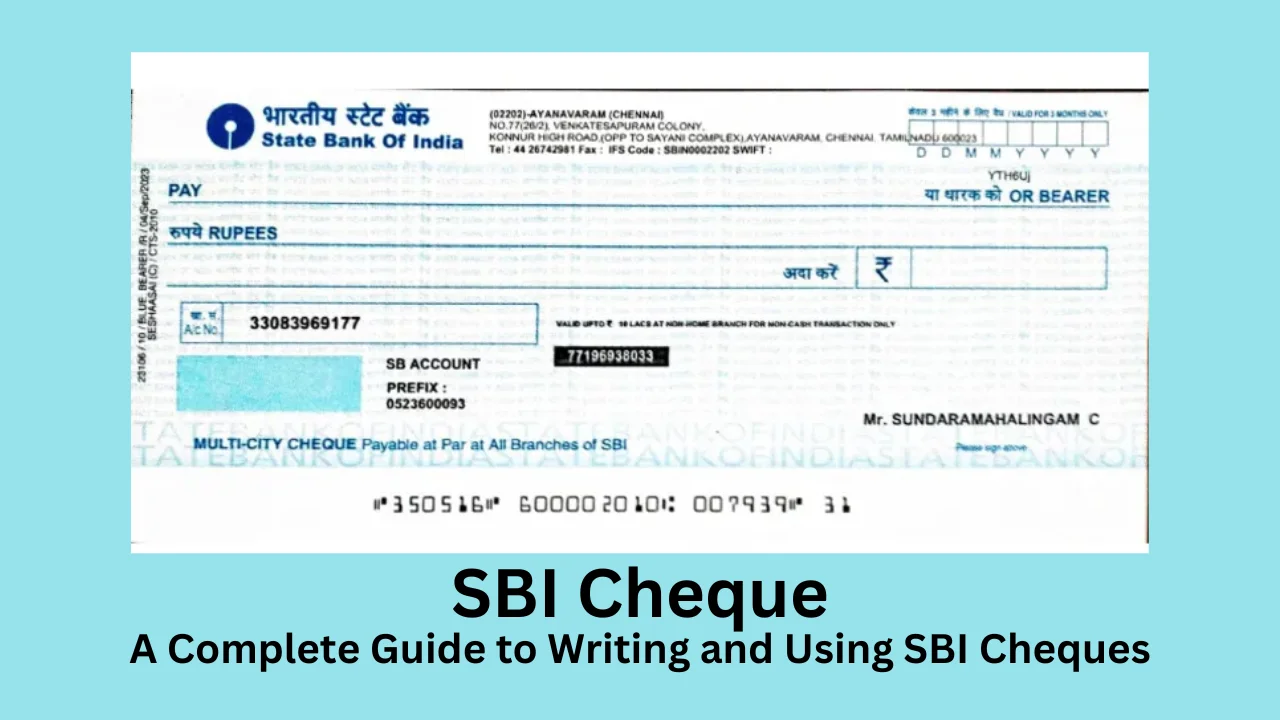

SBI Cheque: A Complete Guide to Writing and Using SBI Cheques

SBI cheque remains one of the most trusted methods for financial transactions in India. Despite the rise of digital banking, many individuals and businesses still prefer cheques for making payments, withdrawing cash, or transferring funds. Understanding the correct way to write, use, and process an cheque is crucial to avoid errors, fraud, or transaction failures.

This guide provides a detailed overview of SBI cheque usage, including how to fill one correctly, safety precautions, and its significance in banking.

Read Also: Maharashtra Gramin Bank Balance Check Number Simplified

Contents [show]

What is an SBI Cheque?

An SBI cheque is a financial document issued by the State Bank of India (SBI) that instructs the bank to pay a specific amount to a person or entity. It serves as an essential financial tool for both individuals and businesses. Whether you need to make payments, withdraw cash, or settle accounts, an SBI cheque provides a reliable method to do so securely.

Types of SBI Cheques

Bearer Cheque – Easy to Encash

A bearer cheque is payable to the person holding the cheque. It does not require identification, meaning anyone who presents it at the bank can withdraw the money.

When to Use a Bearer Cheque?

Suitable for quick cash withdrawals.

Used when you trust the bearer completely.

Helpful for payments where the recipient needs immediate cash.

Risk Factor: Bearer cheques are risky because if lost or stolen, anyone can encash them without the need for further authorization. To avoid fraud, use crossed cheques for high-value transactions.

Order Cheque – Secure and Account-Specific

An order cheque is payable only to the person or organization mentioned on the cheque. Unlike a bearer cheque, it requires proper identification before payment is processed.

When to Use an Order Cheque?

When making payments to businesses, service providers, or individuals.

If you need added security compared to bearer cheques.

Security Tip: To make an order cheque safer, always write “A/C Payee Only” to ensure it is deposited into the intended recipient’s account.

Crossed Cheque – Bank Deposit Required

A crossed cheque has two parallel lines drawn on the top left corner. This type of SBI cheque cannot be encashed directly at the bank. Instead, the funds must be deposited into the recipient’s account.

When to Use a Crossed Cheque?

When making payments to vendors or suppliers.

For large transactions where security is a concern.

When you want to avoid direct cash handling.

Advantage: Crossed cheques provide higher security by ensuring that the funds reach only the intended recipient.

Self-Cheque – For Personal Withdrawals

A self-cheque is used by the account holder to withdraw cash from their own bank account. Instead of writing a payee’s name, the word “Self” is written in the payee field.

When to Use a Self-Cheque?

When withdrawing cash from your SBI account.

If you need immediate funds and prefer cash withdrawal.

Precaution: If a self-cheque is lost, it can be misused by anyone. To enhance security, always keep track of issued cheques.

Post-Dated Cheque – For Future Payments

A post-dated cheque is written with a future date, meaning it cannot be cashed until the specified date arrives.

When to Use a Post-Dated Cheque?

When issuing advance payments for loans or EMIs.

For post-dated salary payments or business contracts.

If you want the cheque to be honored at a later date.

Caution: The cheque must not be deposited before the mentioned date, or the bank will reject the transaction.

Stale Cheque – Expired and Invalid

A cheque that is older than three months from the date of issuance is considered a stale cheque. Banks do not process such cheques.

How to Handle a Stale Cheque?

If a cheque has expired, request the issuer to provide a new cheque.

Always check the date before depositing a cheque.

To avoid cheque expiration, deposit or encash it within the three-month validity period.

Cancelled Cheque – For Verification Purposes

A cancelled cheque has the word “CANCELLED” written across it and cannot be used for any transaction. However, it is often required for bank account verification in various financial processes.

When is a Cancelled Cheque Required?

When applying for loans or credit cards.

For setting up EMI payments.

When opening a Demat account or investing in mutual funds.

Important Note: Never sign a cancelled cheque, as it can lead to fraud.

Banker’s Cheque – Secure and Bank-Guaranteed

A banker’s cheque is issued by SBI on behalf of an account holder, ensuring that the recipient gets paid without the risk of cheque bouncing.

When to Use a Banker’s Cheque?

For making payments in real estate transactions.

When large payments require guaranteed clearance.

For government-related fee payments.

Since the bank itself issues the cheque, there is no risk of insufficient funds.

Demand Draft – Non-Cancelable Payment Mode

A demand draft (DD) is similar to a banker’s cheque but is more secure because it cannot be dishonored. The amount is prepaid, meaning the bank deducts the money before issuing the DD.

When to Use a Demand Draft?

For educational fees, government payments, and international transfers.

When making payments that require high security.

If the recipient does not accept personal cheques.

Demand drafts are widely accepted for formal and legal transactions.

How to Fill an SBI Cheque Correctly?

| Section of Cheque | How to Fill it |

|---|---|

| Date | Write the date in DD/MM/YYYY format. Example: 29/01/2025 |

| Payee Name | Enter the recipient’s full name without errors. |

| Amount in Words | Write the exact amount clearly to avoid tampering. Example: “Rupees Ten Thousand Only.” |

| Amount in Numbers | Mention the amount in figures close to “₹” to prevent alterations. Example: ₹10,000/- |

| Signature | Sign as per the bank’s records. Mismatched signatures lead to rejection. |

| Remarks (Optional) | You may mention the purpose, like “Rent Payment.” |

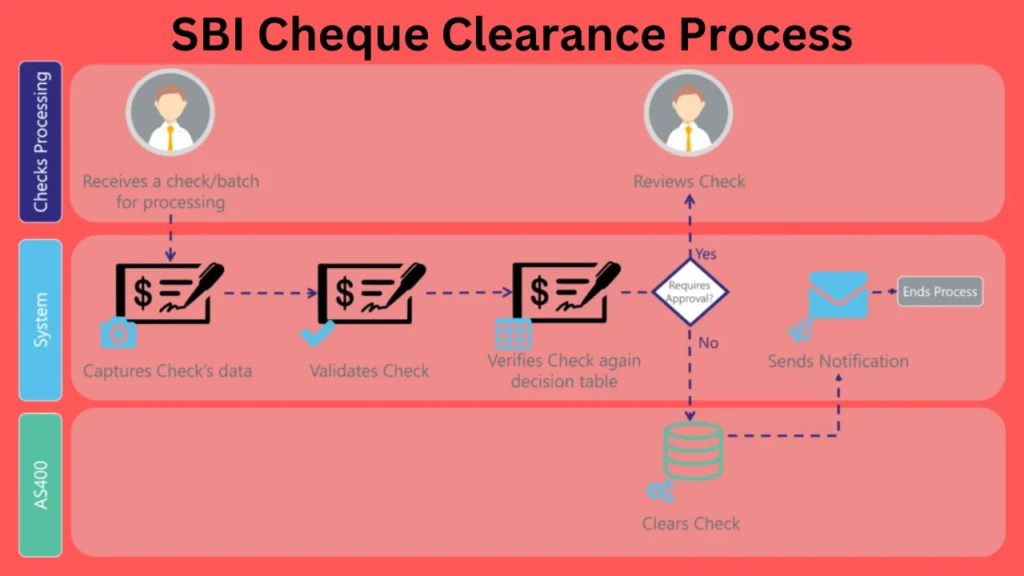

SBI Cheque Clearance Process

When a cheque is issued, the bank follows a process to ensure its legitimacy before clearing the funds. Understanding how the clearance process works can help avoid delays.

Cheque Submission – The recipient deposits the cheque at their bank.

Bank Verification – The cheque details, signature, and fund availability are checked.

Fund Transfer – If everything is in order, the funds are transferred to the recipient’s account.

Cheque Bounce – If there are insufficient funds or signature mismatches, the cheque is returned unpaid.

The entire process usually takes 1-3 working days unless there are any issues with the cheque.

Why Use an SBI Cheque Instead of Digital Transactions?

While digital banking offers convenience, cheques still hold significant advantages in various scenarios:

Large Transactions – Many businesses prefer cheques for transactions exceeding digital payment limits.

Legal Evidence – An SBI cheque provides a physical proof of payment, which can be used in legal matters.

Safer for Large Amounts – Unlike online transactions that can be affected by cyber fraud, cheques offer a layer of security.

Even though digital banking is expanding, cheques remain a preferred method for making secure and recorded payments.

How to Deposit an SBI Cheque?

Depositing an SBI cheque is a simple process. Follow these steps to ensure a smooth transaction:

Fill out a cheque deposit slip available at the bank.

Mention the cheque number, date, and payee details on the slip.

Sign the deposit slip if required.

Attach the cheque to the slip and drop it in the cheque deposit box or hand it over at the counter.

After deposit, the cheque typically takes 1-3 business days to clear. If there are any issues, you may be notified by the bank.

Precautions to Take While Using SBI Cheques

To avoid fraud or rejection, follow these safety measures:

Never sign a blank cheque. This can lead to financial misuse.

Always cross a cheque if it is meant for account transfer only.

Use permanent ink to prevent alterations.

Keep a record of issued cheques to track payments.

Strike out “Bearer” if the cheque is for a specific payee.

These simple precautions can prevent financial loss and unauthorized transactions.

Read Also: Aadhar Card Se Bank Balance Check: Complete Information

What to Do If an SBI Cheque Bounces?

A bounced cheque can cause inconvenience and penalties. If your cheque is dishonored, follow these steps:

Check the Reason – The bank will notify you about the issue (insufficient funds, signature mismatch, etc.).

Communicate with the Payee – If it’s a payment to someone else, inform them immediately.

Reissue the Cheque – If needed, issue a new cheque with correct details.

Avoid Legal Trouble – Frequent cheque bounces can result in legal action under the Negotiable Instruments Act, 1881.

To prevent such issues, always ensure your account has sufficient balance before issuing a cheque.

SBI Cheque vs. Digital Payments: Which is Better?

| Feature | SBI Cheque | Digital Payment |

|---|---|---|

| Transaction Time | 1-3 Days | Instant |

| Security | High (Physical Verification) | Risk of Cyber Fraud |

| Usage | Suitable for Large Payments | Best for Small Payments |

| Proof of Payment | Physical Evidence | Digital Receipt |

Conclusion

An SBI cheque continues to be a crucial financial instrument despite the rise of digital banking. It offers a secure, recorded, and reliable method for transactions, especially for businesses and large payments. Knowing how to correctly write, deposit, and handle cheques ensures smooth financial dealings while preventing fraud.

By following this guide, you can confidently manage SBI cheque transactions without errors. Whether you are a beginner or a frequent cheque user, understanding these essentials will help you make informed financial decisions.