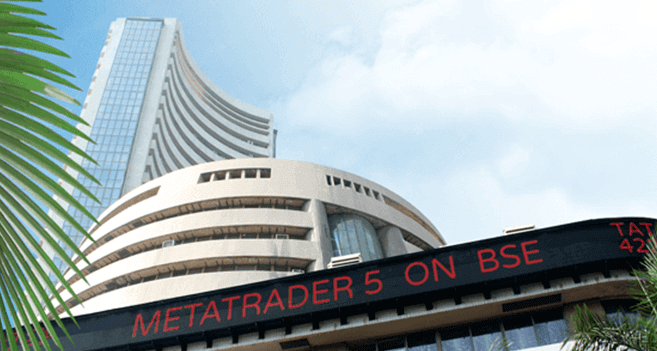

BSE: Oldest stock market in our country

The Bombay Stock Market, also known as BSE, was the first stock market established in India and has the longest history in Asia. It was founded in 1875, is based in Mumbai, and goes by the name BSE Limited. One of India’s top exchanges, BSE is important to the nation’s financial markets.

BSE was established in 1875 as “The Native Share and Stock Brokers’ Association” by a group of brokers who transacted business in Mumbai under a banyan tree. It has developed into one of the most significant stock exchanges in Asia over time, with a market capitalisation of more than $2 trillion.

Here is some more detail regarding the bse live:

- Listing prerequisites:A company must meet certain criteria in order to list on the BSE. Having a minimum paid-up capital of Rs. 10 crores, a track record of profitability for at least three years, and a minimum public shareholding of 10% are a few of these requirements. Companies must also adhere to a number of listing and disclosure standards set forth by BSE, including those relating to corporate governance principles, annual reports, and quarterly financial statements.

- Indexes: The BSE maintains a number of indexes that monitor the performance of various market categories. The S&P BSE Sensex, a benchmark index that measures the performance of the 30 largest and most liquid equities listed on BSE, is the most well-known of these. The S&P BSE 500, which monitors the performance of the top 500 businesses listed on the BSE, and the BSE Small-Cap index, which tracks the performance of small-cap stocks, are two more noteworthy indexes.

- Products: BSE provides merchants and investors with a variety of goods and services. Equities, derivatives, mutual funds, debt instruments, and currency derivatives are some examples of these. The BSE Commodity Derivatives sector of the BSE is a platform for commodity trading as well.

- Technology: BSE has made significant investments in this area to make sure that its trading platform is quick, dependable, and safe. The BSE Online Trading (BOLT) platform, a completely automated system that enables real-time trading of securities, serves as the foundation for its trading system. To ensure that trading can continue in the event of a system outage, BSE also maintains a disaster recovery site.

Securities and Exchange Board of India (SEBI), the primary regulator of the Indian securities market, oversees the BSE. BSE’s compliance with different rules and regulations is ensured by SEBI, which also supervises the listing and trading of securities on the exchange.

In conclusion, BSE is one of India’s top stock exchanges and an important player in the financial markets of the nation. It has a long history and provides traders and investors with a variety of goods and services. BSE makes sure that its trading platform is fair, transparent, and secure by adhering to several regulations and strict listing standards. Bse midcap index is well-positioned to continue contributing significantly to India’s economic growth in the years to come thanks to its focus on technology and innovation. 5paisa provides various services on both exchange boards.