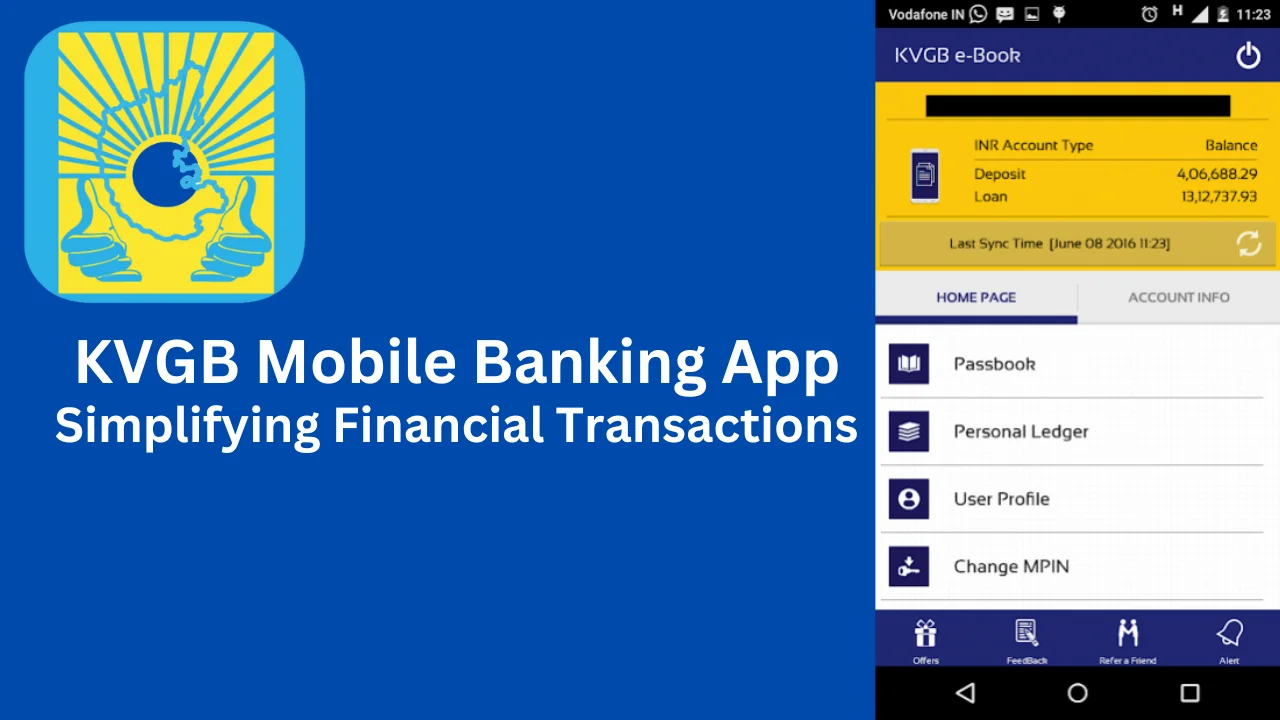

KVGB Mobile Banking App: Simplifying Financial Transactions

In today’s fast-paced world, the ability to manage your finances on the go has become a necessity. For customers of Karnataka Vikas Grameena Bank (KVGB), the KVGB Mobile Banking App offers a seamless and user-friendly platform to perform various banking activities anytime, anywhere. Designed with advanced technology and user convenience in mind, this app is transforming the way customers interact with their bank.

Contents [show]

What is the KVGB Mobile Banking App?

The KVGB Mobile Banking App is an innovative tool that allows Karnataka Vikas Grameena Bank customers to access their accounts digitally. It eliminates the need for physical visits to the bank by bringing all essential banking services to your smartphone. Whether it’s transferring funds, paying bills, or checking your account balance, the app ensures you have everything you need at your fingertips.

Read Also: Maharashtra Gramin Bank Balance Check Number Simplified

Features of the KVGB Mobile Banking App

The KVGB Mobile Banking App is a comprehensive digital platform designed to meet the banking needs of Karnataka Vikas Grameena Bank customers. Its array of features ensures convenience, security, and efficiency, making it a go-to solution for all financial tasks. Let’s dive into the key features that set this app apart.

Instant Account Access

One of the standout features of the KVGB Mobile Banking App is the ability to access your account instantly. Whether you want to check your balance, view transaction history, or download statements, the app ensures you have all this information at your fingertips. This saves time and eliminates the need to visit the bank for routine inquiries.

Secure Fund Transfers

The app supports multiple fund transfer options, including NEFT, IMPS, and RTGS. These systems allow users to transfer money securely and efficiently, whether they’re sending funds within the same bank or to accounts in other banks. With real-time processing, fund transfers are faster than ever.

Bill Payments Made Easy

The KVGB Mobile Banking App makes it simple to pay utility bills such as electricity, water, and mobile recharges. The bill payment feature is user-friendly and supports multiple service providers, ensuring that customers can manage all their payments in one place. Scheduled payment options add another layer of convenience.

Mini-Statement and Account Monitoring

Tracking your financial activities is crucial, and the app provides a mini-statement feature that lists your recent transactions. This feature enables customers to monitor their accounts and stay updated on their spending patterns. Real-time notifications ensure you’re always informed about account activities.

Quick Access to Banking Services

The app acts as a one-stop solution for all banking needs. Customers can:

Apply for loans.

Open fixed or recurring deposit accounts.

Access information about the latest bank offers and schemes.

This centralized access saves customers time and effort while keeping them updated on the bank’s services.

24/7 Availability

Unlike traditional banking, which is limited to working hours, the KVGB Mobile Banking App is available round the clock. Customers can perform transactions, check balances, or access services at any time, ensuring convenience, especially for those with busy schedules or in remote locations.

Easy Registration Process

The app ensures that registering is a hassle-free experience. With a few simple steps—such as downloading the app, entering your registered mobile number, and setting up a secure PIN—customers can get started quickly. The user-friendly registration process ensures that even those new to mobile banking can easily onboard.

Enhanced Security Features

Security is a top priority for the KVGB Mobile Banking App. The app uses:

End-to-end encryption to protect sensitive data.

Multi-factor authentication for added security.

Automatic logout features to prevent unauthorized access.

These measures provide customers with peace of mind while performing digital transactions.

Alerts and Notifications

The app sends instant alerts and notifications to customers for every transaction. From fund transfers to bill payments, customers are immediately informed about their account activities. This feature not only enhances transparency but also helps in identifying unauthorized activities promptly.

Support for Multiple Languages

Understanding the needs of its diverse customer base, the KVGB Mobile Banking App supports multiple regional languages in addition to English. This ensures that customers from various linguistic backgrounds can use the app with ease.

Integration with Government Schemes

The app is integrated with government initiatives like Direct Benefit Transfer (DBT). This allows customers to receive subsidies, pensions, and other benefits directly into their accounts, streamlining the process and ensuring transparency.

Missed Call Banking

For customers who may not have access to the internet, the app supports missed call banking. Users can give a missed call from their registered mobile number to check their balance or get mini-statements. This feature complements the app’s offerings and ensures accessibility for everyone.

Why Choose the KVGB Mobile Banking App?

One of the biggest advantages of the KVGB Mobile Banking App is the level of convenience it offers. It’s more than just a banking tool; it’s a comprehensive solution for managing finances. Here are some reasons why customers prefer it:

Ease of Use: The app is designed for customers of all age groups. Its simple interface ensures that even those who are new to smartphones can navigate it with ease.

Secure Transactions: With advanced encryption and multi-factor authentication, the app prioritizes the safety of your data and transactions.

Time-Saving Features: No more waiting in long queues. With the app, you can perform essential banking tasks from the comfort of your home.

Availability Around the Clock: Unlike traditional banking hours, the app is accessible 24/7, making it highly convenient for people with busy schedules.

How to Register and Use the KVGB Mobile Banking App

Getting started with the KVGB Mobile Banking App is quick and straightforward. Follow these steps to register and begin using it:

Download the app from Google Play Store or Apple App Store.

Use your registered mobile number to sign up.

Enter the one-time password (OTP) sent to your mobile device.

Create a unique PIN for secure access to the app.

Link your bank account to complete the setup.

Once registered, you can start using the app to perform various banking tasks.

Read Also: Aadhar Card Se Bank Balance Check: Complete Information

Benefits of the KVGB Mobile Banking App

The KVGB Mobile Banking App is more than just a convenience; it’s a financial powerhouse that brings numerous benefits. Here’s a quick comparison of how the app enhances your banking experience:

| Feature | Traditional Banking | KVGB Mobile Banking App |

|---|---|---|

| Accessibility | Limited to bank hours | Available 24/7 |

| Transaction Time | Can take hours | Instant transactions |

| Physical Effort | Requires branch visits | Operate from anywhere |

| Cost | Travel and time expenses | Free to use |

| Account Monitoring | Requires passbook updates | Real-time updates |

This table highlights how the app is revolutionizing banking for KVGB customers.

A Tool for Rural Empowerment

Karnataka Vikas Grameena Bank has always been committed to empowering rural communities, and the KVGB Mobile Banking App is a reflection of this mission. By providing a digital platform for banking, it bridges the gap between rural areas and financial inclusion. Farmers, small business owners, and other rural customers now have easy access to essential banking services without the need for travel.

The app also supports government initiatives like Direct Benefit Transfer (DBT), allowing customers to receive subsidies and financial aid directly into their accounts. This not only saves time but also ensures transparency in transactions.

Addressing Security Concerns

While digital banking offers numerous advantages, security is always a concern. The KVGB Mobile Banking App takes this seriously. It employs state-of-the-art encryption to protect your personal information and financial data. Additionally, the app requires multi-factor authentication, ensuring that only authorized users can access the account.

To further enhance security, customers are advised to:

Never share their app PIN or password.

Update the app regularly to benefit from the latest security features.

Avoid using public Wi-Fi while accessing the app.

By following these guidelines, you can enjoy a safe and secure banking experience.

Customer Support and Assistance

If you encounter any issues with the KVGB Mobile Banking App, the bank offers robust customer support. You can reach out to their dedicated helpline at 18008906766 for assistance. The team is available during working hours to help resolve your queries promptly.

For general queries, customers can also visit the nearest branch or explore the detailed FAQ section within the app. With a strong focus on customer satisfaction, Karnataka Vikas Grameena Bank ensures that you have the support you need to make the most of its mobile banking services.

Conclusion

The KVGB Mobile Banking App is a game-changer for Karnataka Vikas Grameena Bank customers. By combining advanced technology with user-friendly features, the app offers a convenient, secure, and efficient way to manage finances. Whether you need to transfer money, pay bills, or monitor your account, this app ensures you can do it all with ease.

As digital banking continues to evolve, the KVGB Mobile Banking App stands out as a reliable and accessible tool for anyone looking to simplify their financial tasks. If you haven’t already, download the app today and take control of your banking experience.